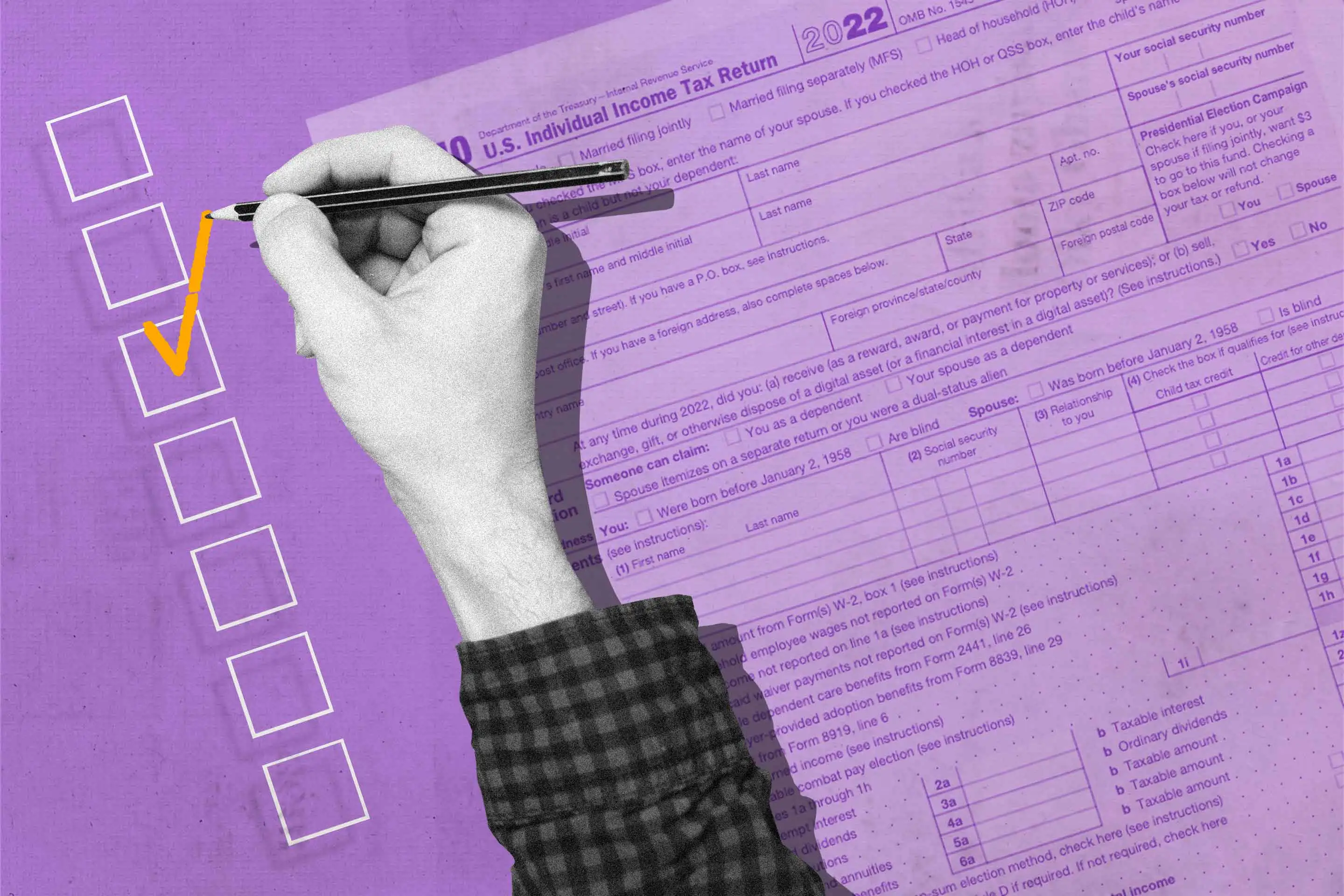

FICA Tax in 2022-2023: What Small Businesses Need to Know

Por um escritor misterioso

Last updated 03 julho 2024

FICA taxes are paid by all workers. The FICA taxes are paid based on your total income from all sources. Here is what small businesses need to know.

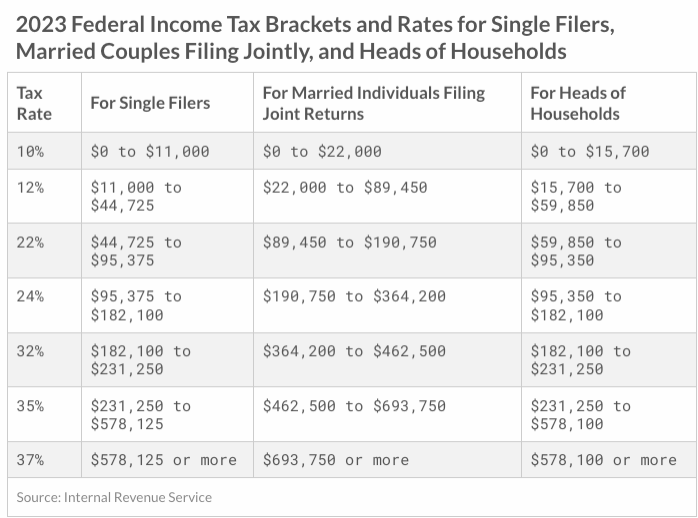

Here Are the Federal Income Tax Brackets for 2022 and 2023

2023 FICA Tax Limits and Rates (How it Affects You)

When Are Taxes Due in 2022? – Forbes Advisor

What are FICA Taxes? 2022-2023 Rates and Instructions

2023 Tax Brackets, Social Security Benefits Increase, and Other

2024 State Business Tax Climate Index

FICA Tax in 2022-2023: What Small Businesses Need to Know

Publication 915 (2022), Social Security and Equivalent Railroad

Tax & Accounting Research - Tax Updates December 2023

Social Security wage base is $160,200 in 2023, meaning more FICA

Small-Business Tax Changes and Tips to Know in 2023 - NerdWallet

FICA Tax in 2022-2023: What Small Businesses Need to Know

Recomendado para você

-

What is Fica Tax?, What is Fica on My Paycheck03 julho 2024

What is Fica Tax?, What is Fica on My Paycheck03 julho 2024 -

Family Finance Favs: Don't Leave Teens Wondering What The FICA?03 julho 2024

Family Finance Favs: Don't Leave Teens Wondering What The FICA?03 julho 2024 -

Overview of FICA Tax- Medicare & Social Security03 julho 2024

Overview of FICA Tax- Medicare & Social Security03 julho 2024 -

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers03 julho 2024

Requesting FICA Tax Refunds For W2 Employees With Multiple Employers03 julho 2024 -

FICA Tax: Understanding Social Security and Medicare Taxes03 julho 2024

-

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet03 julho 2024

FICA Tax Rate: What Are Employer Responsibilities? - NerdWallet03 julho 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations03 julho 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations03 julho 2024 -

What Is FICA on a Paycheck? FICA Tax Explained - Chime03 julho 2024

What Is FICA on a Paycheck? FICA Tax Explained - Chime03 julho 2024 -

Withholding FICA Tax on Nonresident employees and Foreign Workers03 julho 2024

Withholding FICA Tax on Nonresident employees and Foreign Workers03 julho 2024 -

What is FICA tax? Are you struggling to understand what the FICA tax is and if you need to pay it as a small business owner? Check out this video, and03 julho 2024

você pode gostar

-

Pixilart - 32x32 Chibi Base by dragonkey03 julho 2024

Pixilart - 32x32 Chibi Base by dragonkey03 julho 2024 -

Você é a vergonha da profission kkkkk : r/ballutverso03 julho 2024

Você é a vergonha da profission kkkkk : r/ballutverso03 julho 2024 -

Kinnikuman Muscle Grand Prix, satan Cross, Kinnikuman, chrono03 julho 2024

Kinnikuman Muscle Grand Prix, satan Cross, Kinnikuman, chrono03 julho 2024 -

u don't feel the same - lagu dan lirik oleh sushant, Shiloh Dynasty, Ajuktion03 julho 2024

-

HILL CLIMB RACING 2 MOD DO DINHEIRO INFINITO (ATUALIZADO 2017)03 julho 2024

HILL CLIMB RACING 2 MOD DO DINHEIRO INFINITO (ATUALIZADO 2017)03 julho 2024 -

Assistir Miru Tights - Todos os Episódios03 julho 2024

Assistir Miru Tights - Todos os Episódios03 julho 2024 -

Calda De Sereia Vestido De Sereia Para Meninas Cauda Cosplay Traje De Banho Infantil03 julho 2024

-

Arkanjos Guild03 julho 2024

-

What does 'Shabbat Shalom' mean? - Quora03 julho 2024

-

Purble Place - Download03 julho 2024

Purble Place - Download03 julho 2024