Next up on Synapse's fintech services platform: White-labeled credit products

Por um escritor misterioso

Last updated 04 julho 2024

When Sankaet Pathak co-founded Synapse in 2014, he had a vision of doing more than just building a platform that enables banks and fintech companies to easily develop financial services. He wanted to build a company that helped provide greater access to financial services to a larger pool of people — regardless of their net […]

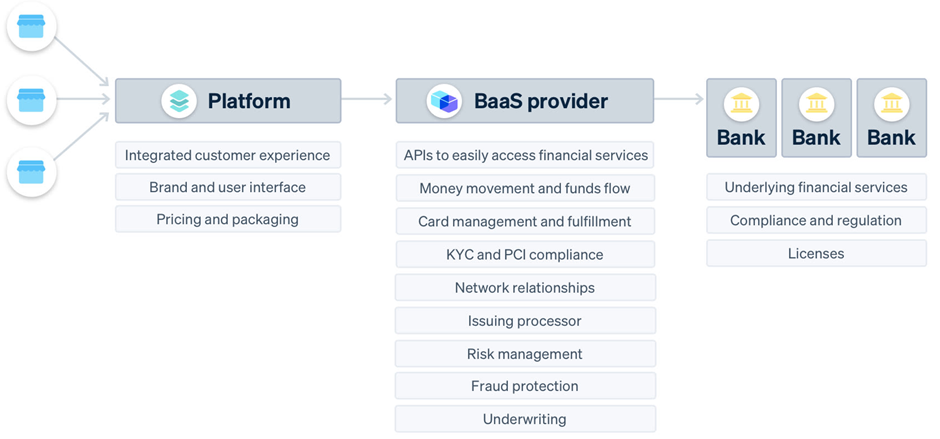

Embedded finance: a game-changing opportunity for incumbents

.webp)

Synapse Embedded Finance News and Resources

Report: Unit's Business Breakdown & Founding Story

White Label Fintech Platform: Pros And Cons

Embedded finance: a game-changing opportunity for incumbents

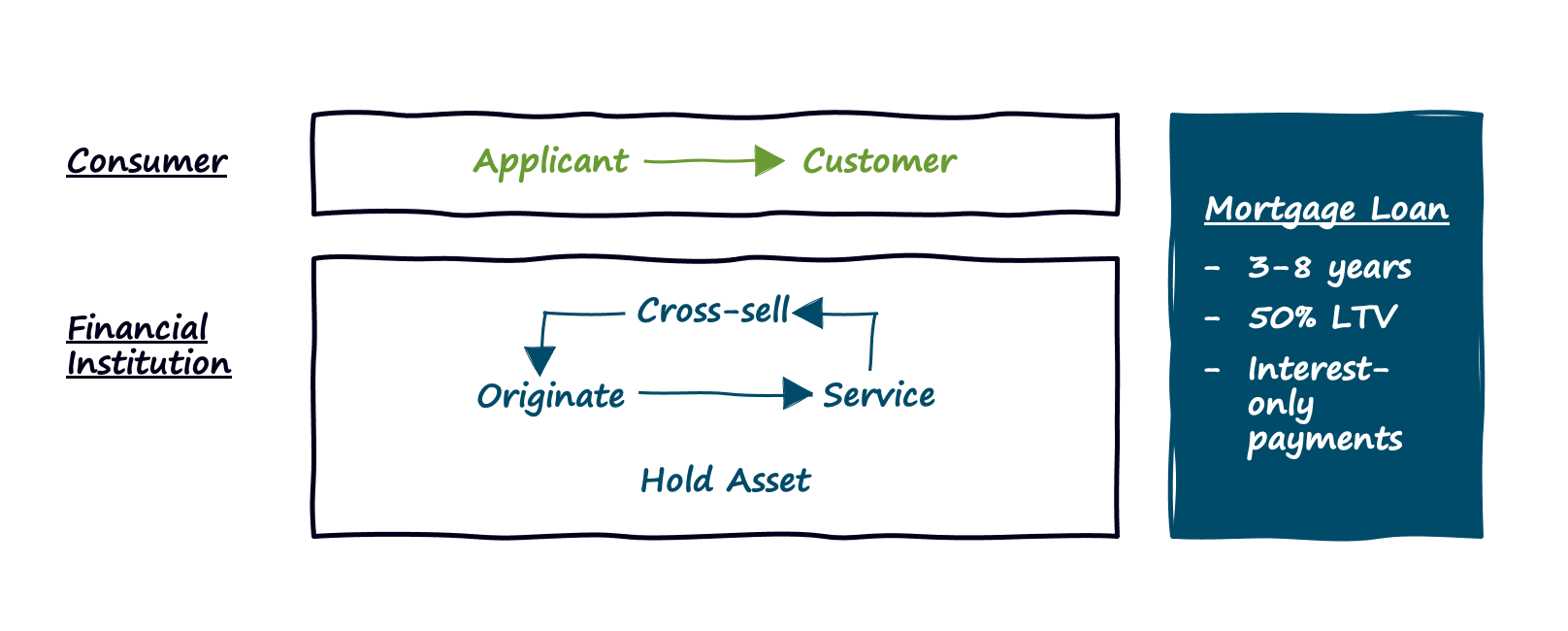

Reimagining Mortgage Servicing - by Alex Johnson

FinTech Focus: Digital Payments in Financial Services

The state of the BaaS market. A glimpse into Banking as a Service

CORRECTING and REPLACING Synapse Expands C-Suite With Two New

Synapse Open Banking Infrastructure Platform

Recomendado para você

-

![How to Join Synapse X Discord [Fast & Simple] - Alvaro Trigo's Blog](https://alvarotrigo.com/blog/assets/imgs/2023-07-26/click-message-join-synapse-x-discord.jpeg) How to Join Synapse X Discord [Fast & Simple] - Alvaro Trigo's Blog04 julho 2024

How to Join Synapse X Discord [Fast & Simple] - Alvaro Trigo's Blog04 julho 2024 -

2023 Synapse x failed to download launcher data research This04 julho 2024

-

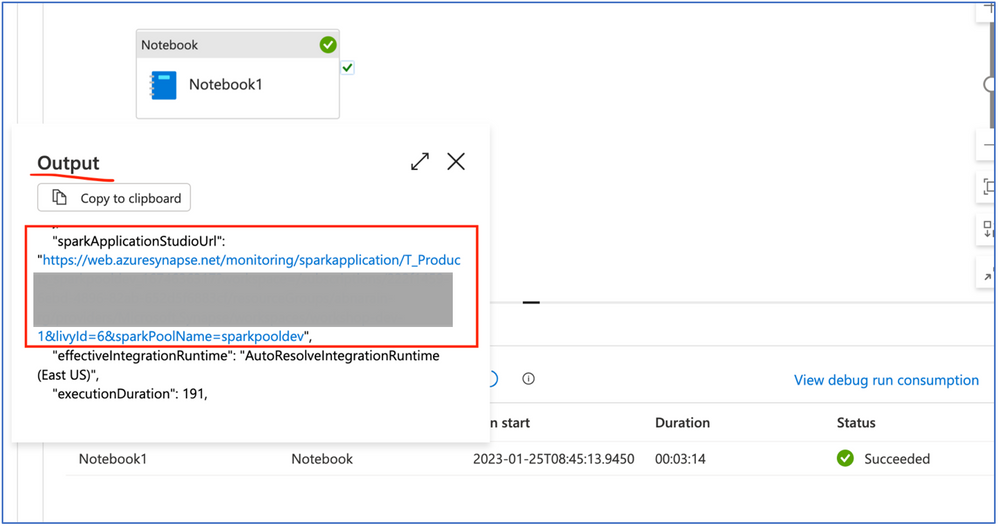

Orchestrate and operationalize Synapse Notebooks and Spark Job Definitions from Azure Data Factory04 julho 2024

-

Frozen Synapse 2 review04 julho 2024

Frozen Synapse 2 review04 julho 2024 -

SynapseX (@SynapseX1) / X04 julho 2024

SynapseX (@SynapseX1) / X04 julho 2024 -

BitAntiCheat - A server-sided, general purpose anti-cheat! - Community Resources - Developer Forum04 julho 2024

BitAntiCheat - A server-sided, general purpose anti-cheat! - Community Resources - Developer Forum04 julho 2024 -

Spaceborne data analysis with Azure Synapse Analytics - Azure Architecture Center04 julho 2024

-

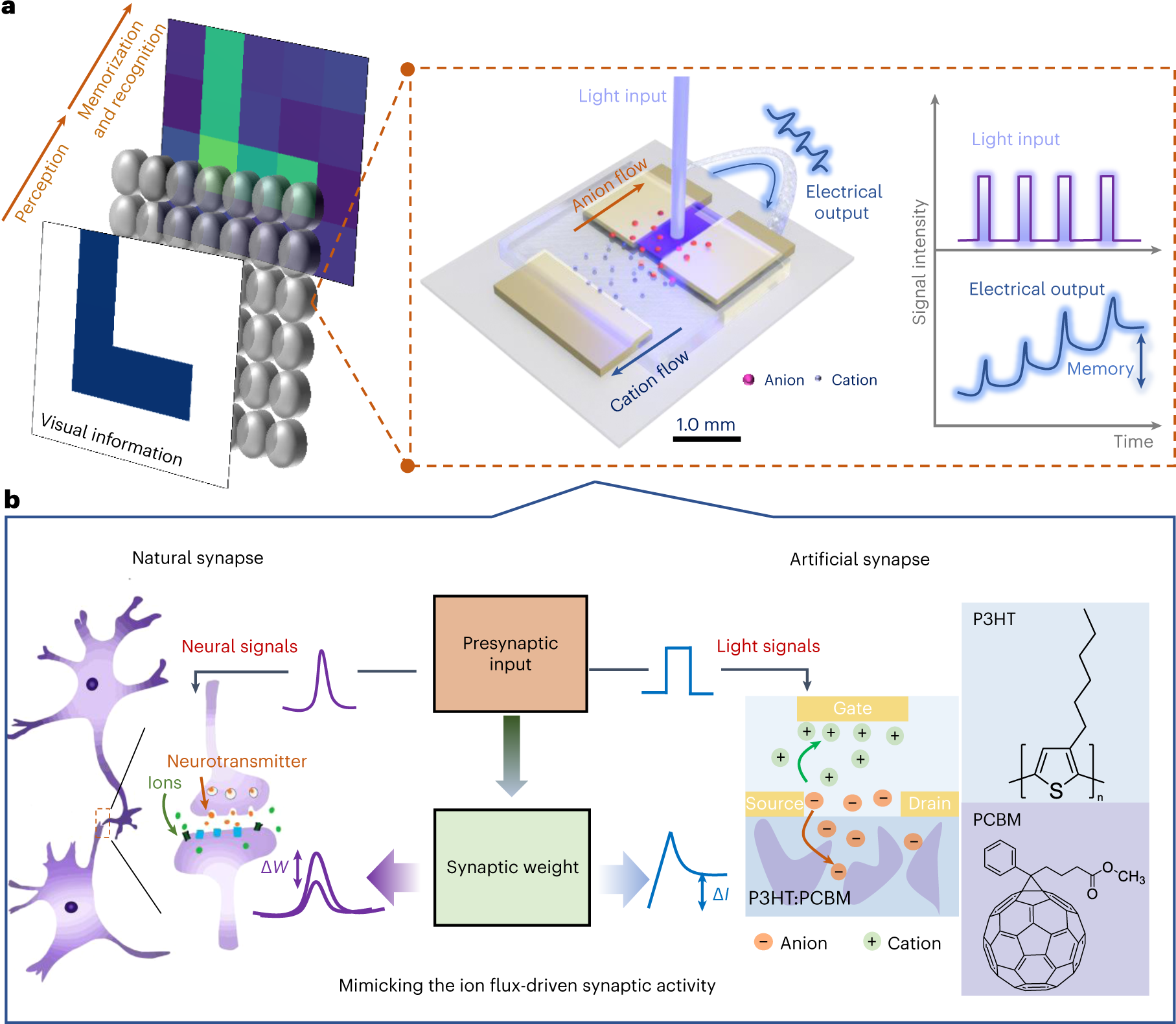

Organic optoelectronic synapse based on photon-modulated electrochemical doping04 julho 2024

Organic optoelectronic synapse based on photon-modulated electrochemical doping04 julho 2024 -

Azure Synapse vs Snowflake- Best One For Big Data Projects?04 julho 2024

Azure Synapse vs Snowflake- Best One For Big Data Projects?04 julho 2024 -

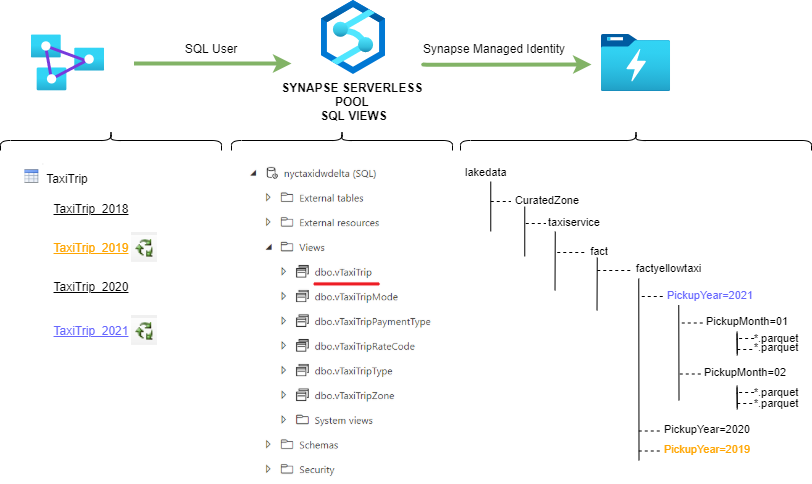

Using Azure Analysis Services With Azure Synapse Serverless04 julho 2024

você pode gostar

-

the thundermans #thethundermans🖤 #entendermos #fy #fypシ #nickelodeon04 julho 2024

-

Fruit Ninja04 julho 2024

Fruit Ninja04 julho 2024 -

Zoo Tycoon players meet first Community Challenge supporting Sumatran Tiger Survival Program04 julho 2024

Zoo Tycoon players meet first Community Challenge supporting Sumatran Tiger Survival Program04 julho 2024 -

Shiny Palkia live : r/TheSilphRoad04 julho 2024

Shiny Palkia live : r/TheSilphRoad04 julho 2024 -

Bocchi The Rock! Image by Nid417 #3928061 - Zerochan Anime Image Board04 julho 2024

Bocchi The Rock! Image by Nid417 #3928061 - Zerochan Anime Image Board04 julho 2024 -

luci faccioli - Advogada - ASSESSORIA JURIDICA04 julho 2024

-

My Summer Car Wiki - Electronics, HD Png Download , Transparent04 julho 2024

My Summer Car Wiki - Electronics, HD Png Download , Transparent04 julho 2024 -

Hachinan tte Sore wa Nai Deshou! Wendelin Elize Erwin Anime manga wall Poster solid wood hanging scroll with canvas painting - AliExpress04 julho 2024

Hachinan tte Sore wa Nai Deshou! Wendelin Elize Erwin Anime manga wall Poster solid wood hanging scroll with canvas painting - AliExpress04 julho 2024 -

PARAPPA THE RAPPER Parappa 7.4 Plush Doll Japan Kawaii Anime04 julho 2024

PARAPPA THE RAPPER Parappa 7.4 Plush Doll Japan Kawaii Anime04 julho 2024 -

Attack on Titan Wiki on X: Attack on Titan The Final Season Part 3 (Part 2) will come out in Fall 2023! #AttackonTitanFinalSeasonPart3 / X04 julho 2024

Attack on Titan Wiki on X: Attack on Titan The Final Season Part 3 (Part 2) will come out in Fall 2023! #AttackonTitanFinalSeasonPart3 / X04 julho 2024