Federal Insurance Contributions Act (FICA): What It Is, Who Pays

Por um escritor misterioso

Last updated 01 julho 2024

:max_bytes(150000):strip_icc()/papers-with-fica-federal-insurance-contributions-act-tax--625206358-2b7a46b78de54753a70d54c452429876.jpg)

The Federal Insurance Contributions Act (FICA) is a U.S. payroll tax deducted from workers

What are FICA Taxes? Social Security & Medicare Taxes Explained

Which taxes are only paid by the employer? - Quora

What is Fica Tax?, What is Fica on My Paycheck

Federal Insurance Contributions Act (FICA)

Federal Insurance Contributions Act (FICA)

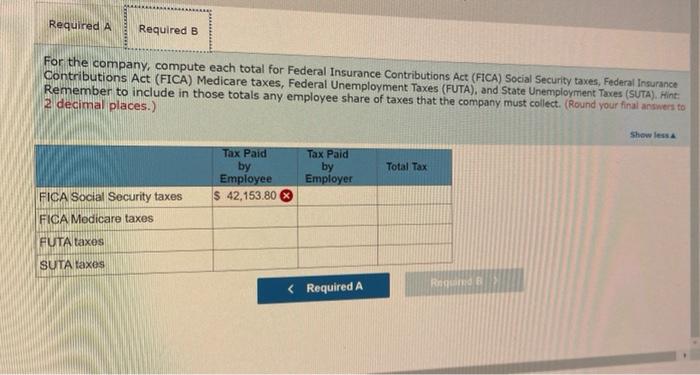

Solved Mest Company has nine employees. FICA Social Security

What is FICA? Beverly, MA Patch

What is the FICA Tax and How Does it Connect to Social Security?

ACC121 - Accounting 101.docx - An Employee Earned $43 000 During

Federal Insurance Contributions Act: FICA - FasterCapital

Federal Insurance Contributions Act - Wikipedia

The ABCs of FICA: Federal Insurance Contributions Act Explained

:max_bytes(150000):strip_icc()/fica-taxes-social-security-and-medicare-taxes-398257_FINAL-5bbd10af46e0fb00266df9ec-b3794e561e094118ad5b5ed3c6898880.png)

Learn About FICA, Social Security, and Medicare Taxes

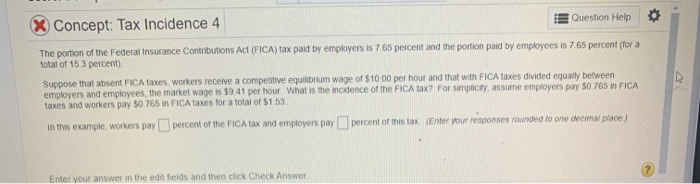

Solved Concept: Tax Incidence 4 Question Help The portion of

An employee earns $6,200 per month working for an employer. The

Recomendado para você

-

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks01 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks01 julho 2024 -

FICA Tax Rate: What is the percentage of this tax and how you can calculated?01 julho 2024

FICA Tax Rate: What is the percentage of this tax and how you can calculated?01 julho 2024 -

Overview of FICA Tax- Medicare & Social Security01 julho 2024

Overview of FICA Tax- Medicare & Social Security01 julho 2024 -

2023 FICA Tax Limits and Rates (How it Affects You)01 julho 2024

2023 FICA Tax Limits and Rates (How it Affects You)01 julho 2024 -

What is the FICA Tax and How Does it Connect to Social Security?01 julho 2024

-

Social Security Administration - “What is FICA on my paycheck?” Find out01 julho 2024

-

What are FICA Tax Payable? – SuperfastCPA CPA Review01 julho 2024

What are FICA Tax Payable? – SuperfastCPA CPA Review01 julho 2024 -

FICA Tax in 2022-2023: What Small Businesses Need to Know01 julho 2024

FICA Tax in 2022-2023: What Small Businesses Need to Know01 julho 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.01 julho 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.01 julho 2024 -

FICA Tax Tip Fairness Pro Beauty Association01 julho 2024

FICA Tax Tip Fairness Pro Beauty Association01 julho 2024

você pode gostar

-

O Assassinato do Conde Julius, O General Dragão Branco. Filme01 julho 2024

-

Vetores e ilustrações de Jogo damas para download gratuito01 julho 2024

Vetores e ilustrações de Jogo damas para download gratuito01 julho 2024 -

Hikari Sawake · AniList01 julho 2024

Hikari Sawake · AniList01 julho 2024 -

Ryze, The Holder of The Lowest Winrate: Will He Receive Yet01 julho 2024

Ryze, The Holder of The Lowest Winrate: Will He Receive Yet01 julho 2024 -

Casas à venda na Avenida Washington Soares - Cambeba, Fortaleza - CE01 julho 2024

Casas à venda na Avenida Washington Soares - Cambeba, Fortaleza - CE01 julho 2024 -

Naruto Uzumaki by no-Hikari on DeviantArt01 julho 2024

Naruto Uzumaki by no-Hikari on DeviantArt01 julho 2024 -

Wario64 on X: Little Buddy Official Kirby Adventure Fighter Kirby 5 Plush Doll is $17 on #ad / X01 julho 2024

Wario64 on X: Little Buddy Official Kirby Adventure Fighter Kirby 5 Plush Doll is $17 on #ad / X01 julho 2024 -

Fen - Encyclopaedia Metallum: The Metal Archives01 julho 2024

Fen - Encyclopaedia Metallum: The Metal Archives01 julho 2024 -

Breaking Santa's Back This Christmas: A 6-Foot-Wide, $1,000 American Girl Dollhouse - WSJ01 julho 2024

-

Top 10 rarest items in Roblox and how to get them01 julho 2024

Top 10 rarest items in Roblox and how to get them01 julho 2024