Overview of FICA Tax- Medicare & Social Security

Por um escritor misterioso

Last updated 03 julho 2024

FICA represents the Federal Insurance Contributions Act, and it's a government tax that businesses and workers pay. FICA Taxes are the fundamental subsidizing focal point for Social Security benefits.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes on Earnings After Full Retirement Age

What Is FICA Tax? A Complete Guide for Small Businesses

FICA Tax Exemption for Nonresident Aliens Explained

FICA and Withholding: Everything You Need to Know - TurboTax Tax

Social Security wage base is $160,200 in 2023, meaning more FICA

Social Security and Medicare • Teacher Guide

Keyword:current fica tax rate - FasterCapital

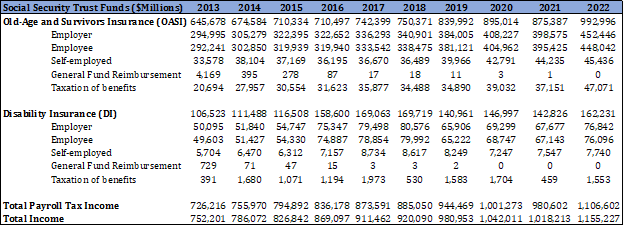

Social Security Financing: From FICA to the Trust Funds - AAF

:max_bytes(150000):strip_icc()/GettyImages-473687780-2bab3391ebc34262a962f386104ed436.jpeg)

How To Calculate Social Security and Medicare Taxes

Credit for Employer Social Security and

Recomendado para você

-

What is the FICA Tax and How Does It Work? - Ramsey03 julho 2024

What is the FICA Tax and How Does It Work? - Ramsey03 julho 2024 -

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks03 julho 2024

What Is FICA, and How Much Is FICA Tax? Payroll taxes, Business tax, Financial life hacks03 julho 2024 -

Social Security Administration - “What is FICA on my paycheck?” Find out03 julho 2024

-

What is the FICA Tax Refund?03 julho 2024

What is the FICA Tax Refund?03 julho 2024 -

What is a payroll tax?, Payroll tax definition, types, and employer obligations03 julho 2024

What is a payroll tax?, Payroll tax definition, types, and employer obligations03 julho 2024 -

The FICA Tax: How Social Security Is Funded – Social Security Intelligence03 julho 2024

The FICA Tax: How Social Security Is Funded – Social Security Intelligence03 julho 2024 -

What it means: COVID-19 Deferral of Employee FICA Tax03 julho 2024

What it means: COVID-19 Deferral of Employee FICA Tax03 julho 2024 -

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.03 julho 2024

Paychex on X: With the possibility of FICA tax rates fluctuating each year, it's essential to stay informed. Discover everything you need to know about these taxes and how to calculate them.03 julho 2024 -

2017 FICA Tax: What You Need to Know03 julho 2024

2017 FICA Tax: What You Need to Know03 julho 2024 -

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg) What Is Social Security Tax? Definition, Exemptions, and Example03 julho 2024

What Is Social Security Tax? Definition, Exemptions, and Example03 julho 2024

você pode gostar

-

The Last Of Us 2 Ellie Edition Edição De Colecionador Ps403 julho 2024

The Last Of Us 2 Ellie Edition Edição De Colecionador Ps403 julho 2024 -

Download do APK de Construindo Casas para Android03 julho 2024

Download do APK de Construindo Casas para Android03 julho 2024 -

Steam Workshop::SCP-300003 julho 2024

-

The last moves of the last rapid tie-break game that made Chinese GM Ding Liren the 17th WORLD CHESS CHAMPION!! 🏆🏆 ______ Follow 👉…03 julho 2024

-

Craftingeek manualidades - Hazlo tú mismo más fácil03 julho 2024

Craftingeek manualidades - Hazlo tú mismo más fácil03 julho 2024 -

Trabalhadores usam a boca para retirar ossos das patas das galinhas - Mundo - Correio da Manhã03 julho 2024

Trabalhadores usam a boca para retirar ossos das patas das galinhas - Mundo - Correio da Manhã03 julho 2024 -

Buy Wholesale China Fire Stick 4k Roku Streaming Stick 4k Fire Stick 4k Max Wholesale Price Fire Tv Stick 4k Max Streaming Device Replacement & Fire Tv Stick Fire Stick03 julho 2024

Buy Wholesale China Fire Stick 4k Roku Streaming Stick 4k Fire Stick 4k Max Wholesale Price Fire Tv Stick 4k Max Streaming Device Replacement & Fire Tv Stick Fire Stick03 julho 2024 -

Plain Meeple - Board Game Coasters (qty 4)03 julho 2024

Plain Meeple - Board Game Coasters (qty 4)03 julho 2024 -

Veja a provável escalação do Brasil para a final olímpica contra a Espanha03 julho 2024

Veja a provável escalação do Brasil para a final olímpica contra a Espanha03 julho 2024 -

Assistir Kimetsu no Yaiba 2 Temporada Ep 5 Dublado » Anime TV Online03 julho 2024

Assistir Kimetsu no Yaiba 2 Temporada Ep 5 Dublado » Anime TV Online03 julho 2024